Insights · December 19th, 2008

In the fall of 2007 I spoke to a housing conference, and argued that the issue about to confront real estate in the United States was not so much the sub-prime mortgage debt crisis, though that was going to be huge. Rather, I suspected, the underlying issue is the severe mismatch between how much houses have come to cost, and how much average people earn. This problem is not going away, and is not part of a normal business cycle. In the U.S. we have simply built too many houses that cost too much.

Prices are coming down of course, and have been for 18 months. How far must they decline to reach a reasonable balance? While for my own benefit I would hope it would not be much – I will be the victim of home equity falling as much as the next person – but I do think that a 20% decline may not be enough.

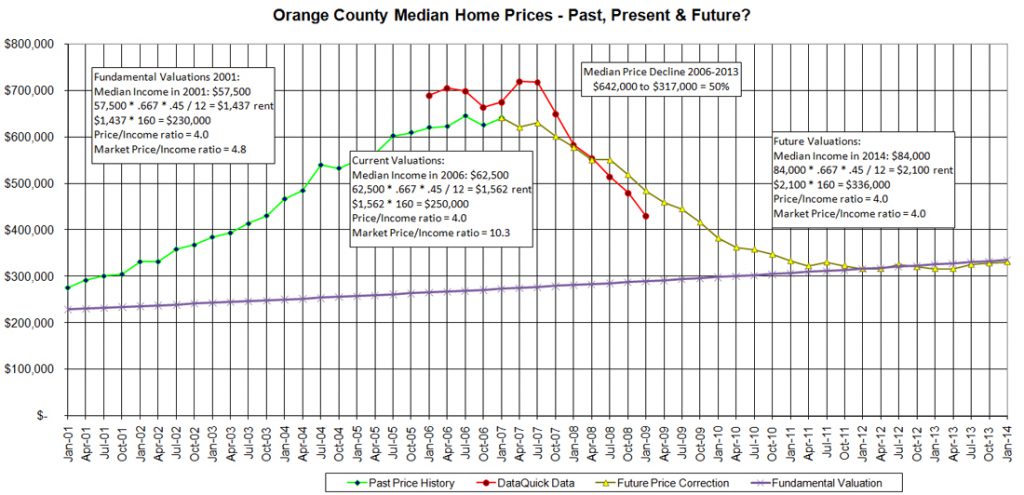

Here is recent evidence from one of the premier real estate blogs that I know, the Irvine Housing Blog. The writer tracks what is happening with home prices in Southern California mostly, with many sad examples of sales at liquidation levels. A couple of blog enries ago, he produced this chart, suggesting that prices may have to come down nearly 50% in order for prices to match actual economic realities.

Read the whole entry and see what you think. Not out of the woods yet.